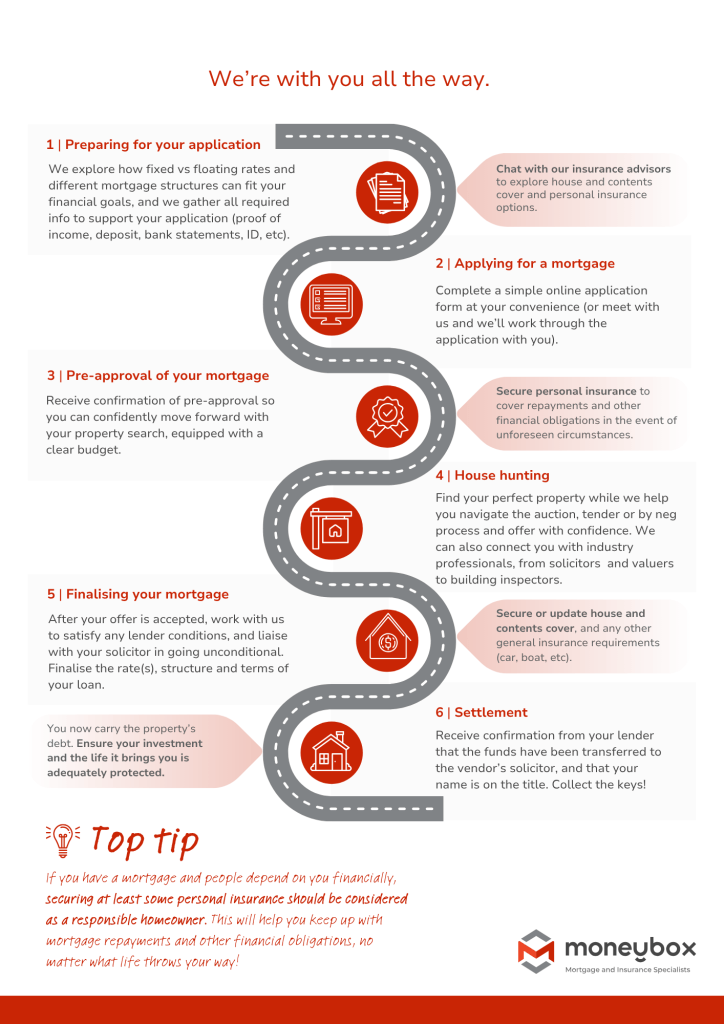

Our mortgage process.

1. Complimentary, no-obligation chat

We’ll meet you wherever it suits you – whether that’s at our Wellington office, at a local café, at your home, via video chat, over the phone or via email. We’re available five days a week and serve clients throughout New Zealand. We’ll get to know you, your goals and circumstances so we can determine what you need in a mortgage.

3. Mortgage application

We can either catch up with you again in person and work through your mortgage application together, or we can supply you with a link to our simple, straightforward application form so you can take the time to complete it yourself when and where it suits – whichever you’d prefer!

5. Confirming finance

Once your offer on a property has been accepted, there are usually a couple of conditions to satisfy before the lender/bank confirms finance unconditionally. We’ll work with you to satisfy the conditions and will contact your solicitor once we’ve received written confirmation from your lender. With your permission, your solicitor will confirm to the vendor’s solicitor that the conditions have been satisfied.

2. Information and documentation

Once we have had an initial discussion and understand how we can best help you, we’ll provide you with a list of the information we require to move forward to the application stage. This information includes confirmation of your household income, proof of your home loan deposit, your bank statements and personal identification.

4. Pre-approval

Having lender pre-approval before you start shopping for property makes the buying process easier. You’ll know exactly how much you can borrow and what your budget is. But we realise this isn’t always possible in the fast-paced property market, so we can help with urgent turnarounds if required.

6. Settlement day

When your lender/bank has declared the loan proceeds to your solicitor, they will then transfer the funds to the vendor’s solicitor. The property is then placed under your name, and you will then receive the call to collect the keys to your new home!