Getting a mortgage is a big deal and a big responsibility. When buying a property, making sure you can protect what you’ve worked hard to secure is just as important as picking up the keys. Some insurance is required by your bank, while other types of cover are just smart to have – especially if you’ve got people depending on you. And it’s a good idea to get sorted early!

House and Contents Insurance

Banks in NZ won’t release your mortgage until you’ve shown proof that your home is insured. It’s also usually included as a condition in the sale and purchase agreement.

The best time to arrange cover is before you make an offer. This helps confirm the property is insurable and lets you budget for premiums. If you already have insurance lined up, you may even be able to remove the ‘house insurance’ clause from your offer, which can help make your offer more competitive!

Contents insurance isn’t compulsory, but it goes hand-in-hand with house insurance and is definitely worth securing. It covers your belongings against things like theft, fire or accidental damage.

Some properties (particularly older homes or those in high-risk areas ) can take longer to assess, so giving yourself a head start is always wise.

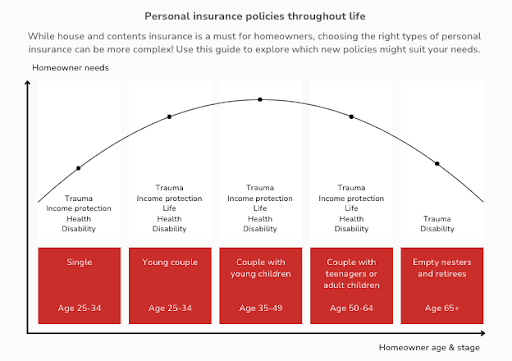

Personal Insurance

Once your offer goes unconditional, you’re officially committed. From here, it’s time to think about protecting your ability to meet those repayments, whatever life throws at you. There are a few types of personal insurance to consider, depending on your situation and what you want to be covered for.

Income and Mortgage Protection

Income and mortgage protection insurance help cover the bills if you can’t work for a while due to illness or injury. Income protection replaces part of your income, so you can stay on top of living costs while you recover. Mortgage protection is more focused – it covers just your mortgage repayments and can be used alongside ACC payments. If you’re self-employed, have minimal sick leave, or you’re the main earner, this kind of cover is especially valuable.

Life Insurance

Life insurance provides a lump sum to your partner or family if you pass away or are diagnosed with a terminal illness. For many homeowners, that lump sum is used to pay off the mortgage so your family isn’t left struggling with repayments at an already difficult time. It can also help cover things like funeral costs or lost income. It’s a simple, effective way to help protect the people who rely on you.

Trauma Insurance

Trauma insurance pays out a lump sum if you’re diagnosed with a serious condition like cancer, stroke, or heart attack. The money can be used however you wish – treatment, recovery time, lost income, or anything else that helps you and your family get back on track. It’s a good option for anyone without a big buffer of savings, and is often added to a life insurance policy for more comprehensive cover.

Disability Insurance

If an illness or injury means you can’t return to work, disability insurance steps in. It pays a one-time lump sum which you can use however you need, whether that’s clearing the mortgage, modifying your home, or planning for the future. While income protection helps during short-term setbacks, disability cover is there for those long-term “what ifs.”

Health Insurance

Health insurance isn’t essential for everyone, but it gives you more choice and faster access to care. If you want to avoid long public hospital waitlists or have more control over where and when you’re treated, it’s a solid option. Especially if you’re self-employed or managing work and family life.

When should you get your insurance sorted?

The earlier, the better. Ideally before your offer is accepted or goes unconditional. Here’s why:

– You’re covered from the day you take ownership.

– Your current health affects your application, so locking in cover early can avoid higher costs or exclusions if your health changes

– There’s one less thing to worry about during the busy lead-up to settlement.

If you already have some insurance in place, this is a good time to check whether it still meets your needs. A new property or bigger mortgage might mean it’s time for a review.

What will it cost?

Insurance doesn’t have to break the bank. You can start with a basic level of cover and build from there. Most policies can be tailored by adjusting your excess, choosing a longer wait period before payments begin, or trimming down your benefits.

Generally, the younger and healthier you are when you apply for personal insurance, the lower your premiums will be. But even if you’re a little later in the game, there are still ways to set up affordable, effective cover that fits your budget.

We’re here to help

There’s already a lot to think about when buying a home. Our job is to take the guesswork out of protecting your investment and the life it brings you.

We work with a range of insurers and can help you find cover that fits your needs, budget, and stage of life – whether you’re buying on your own, with a partner, purchasing your first home, upgrading, or investing. Book a free, no-obligation chat today.

—

Useful resources

Estimate the cost to rebuild your home

Estimate the cost to replace your home contents