While most New Zealanders insure their homes and cars, over 60% don’t invest in health insurance. Many see it as a luxury, but it can actually bridge the gap in our public healthcare system, offering faster access to healthcare and more treatment options.

New Zealand’s public healthcare system provides free or low-cost care for emergencies and serious illnesses, but for non-urgent treatments, specialist consultations, and medications not funded by Pharmac, long wait times and limited options are common. This is where private health insurance can make a real difference.

To help you better understand your options, we’ve compiled answers to some of the most common questions we’re asked about health insurance.

Why bother with health insurance if there’s a public system?

If you get sick or develop a chronic condition, our public health system will help – eventually. The wait, though, is the number one reason why health insurance is worth considering. It gives you faster access to specialists, elective surgeries, and treatments when you need them. Additionally, health insurance can provide more options, such as selecting your preferred specialist or surgeon.

Health insurance also covers many medications not funded by Pharmac, which can be life-changing for those needing expensive or cutting-edge therapies. The Medsafe approved medication list is far more extensive than the Pharmac-funded medication list, and through health insurance, you can access many of these non-funded medicines.

What kinds of health insurance policies are available?

There are many health insurance policies available, and they differ from insurer to insurer. Most policies fit into three main categories:

Primary Care Cover: Covering the costs of everyday care like GP visits, physio appointments, and prescription costs.

Major Medical/Hospital Care Cover: To help pay for bigger things like specialist care, surgery, cancer treatment, and hospital visits.

Comprehensive Cover: A combination of both.

The type of health insurance you need depends on your situation. If you’re generally healthy, rarely see the doctor, and can afford GP visits when you do, you might not need primary care cover. What’s most important to you? Do you want help with everyday medical costs, protection against larger unexpected medical expenses, or faster access to specialists when you need it most?

Keep in mind that health insurance doesn’t cover everything. Common exclusions include fertility treatments, cosmetic procedures, injuries covered by ACC, and conditions caused by substance abuse. Always check your policy wording to avoid surprises.

What does health insurance cost?

Health insurance premiums depend on your age, health, and the type of policy you choose. Generally, the more cover/treatments offered through the policy, the higher the premium. Premiums typically increase as you age, at a rate above inflation each year. For a healthy 25-year-old female (non-smoker), basic cover might cost around $50 a month, while a healthy 55-year-old male (non-smoker) might pay $300 a month (as at Dec 2024).

To keep your health insurance costs down, consider choosing a higher excess or look into pre-payment discounts offered by some insurers, which can save you money if you pay your premiums upfront. Some insurers also offer discounts to customers who have healthy lifestyles. For example, AIA Vitality is AIA’s health and wellbeing programme that supports policyholders to make healthier lifestyle choices and enjoy discounts and rewards for doing so.

Does health insurance cover pre-existing conditions?

Health insurance typically covers new conditions that arise after your policy starts, not pre-existing ones. While most policies won’t cover pre-existing issues like cancer, joint problems, cardiovascular conditions, or transplants, some insurers may offer cover for some pre-existing conditions after a wait period of 3-5 years.

If you have a pre-existing condition that you’d like covered, discuss your situation with our team and we’ll explore the options for you.

Are my kids covered?

To add a child to your existing health insurance policy, it’s usually a straightforward process and may not significantly impact your premiums. By insuring your kids early, you can avoid the high costs of treatments like grommets or tonsil removal and skip the long wait times of the public system.

If you don’t have insurance yet, many providers offer family plans that cover everyone under one policy. However, if someone in your family has a pre-existing condition, it could be cheaper to insure them separately. Some insurers also offer policies for just your child (or even a grandchild, niece, or nephew, etc.), so you have flexible options when it comes to kids’ health insurance.

Am I too old for health insurance?

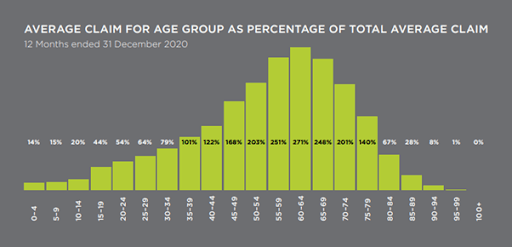

People benefit from health insurance at all ages, from newborns to retirees. Claims data from the Financial Services Council NZ, below, shows that the peak benefit is seen in the 60-64 age group. But remember that you pay more for health insurance as you age, as you’re more likely to need medical treatment as you get older.

How do I make a health insurance claim?

1. See your GP for a referral. If they suggest a specialist, ask for an ‘open referral’ so your insurer can find the right one for you.

2. Contact your insurer’s claims team with your policy number and details about your condition, including the GP’s referral and diagnosis.

3. Your insurer will assess your treatment and confirm if it’s covered under your policy. Remember, insurers typically only pay “reasonable or customary” costs, so confirm any limits on procedures or consultations.

4. Once approved, your insurer will cover your medical bills directly. If you receive a bill, forward it to your insurer for payment or reimbursement.

When reviewing your health insurance or thinking about taking out a new policy, it’s important to take the time to weigh up your options and find a plan that fits your life. If you have a specialist health need or would just prefer to talk to someone directly, get in touch with a Moneybox adviser today. We’ll help you determine the right type and level of cover for you by looking at the full picture – your health history, lifestyle, family situation, and age.